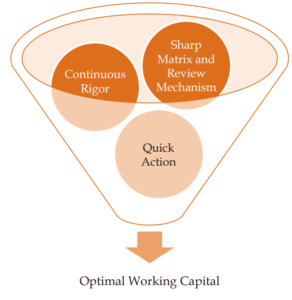

Two plights shared by almost all the founders of startup enterprises: First, start the day checking the bank balance and priorities the urgent payouts from the never-ending list of vendor bills that always pile up like mountain. Second, end the day with a sinking feeling of not recovering the total amount against the invoices. Most companies face the double whammy of the cash crunch cycle. On one side, creditors don’t give leeway in payment; on the other side, debtors take their own sweet time to pay, disregarding the payment terms. The plight becomes unbearable, with unsold inventories further skewing the liquidity position. The problem statement is significant, but the solutions are simple and require continuous rigour.

Working capital – Ingredients

Receivables Management

Receivable management starts when startups enter a contract with the customers. In many cases, the payment terms capture the credit period. But it does not specify other terms, such as the pattern in which the invoice needs to be submitted, pricing calculations, and escalation matrix. Micro, Small and Medium Enterprises Act enables Startups and MSMEs to charge interest @ 2% per month on payment delays beyond 45 days. This is missing in the agreed payment terms.

Even if the above is captured, the receivables management of the company does not incorporate the innovative factoring and bill discounting facilities offered by Banks and NBFCs. Many facilities are like non-fund-based limits and can be utilized against a fraction of cash collateral. Effectively utilizing bill discounting will ensure the long waiting period of cash gets curtailed, and companies can lubricate the growing needs of operations.

Some startups also bring out-of-the-box thinking in receivable management through discounts, rewards, and differential customer experience. SaaS Startups are known for collecting the monthly fee in advance, providing decent discounts on quarterly/annual payments in advance. Whatever approach is taken needs to be evaluated for customer psychology, stickiness to the product and market practice.

With the spurt of various finance solutions, such as Buy Now Pay Later (BNPL), zero-cost EMI solutions to the customers, financing sales upfront against monthly sales and deferred payment and related solutions, it becomes easier to manage receivables. However, it comes with a certain cost and operational complexity. In the above financing mechanisms, if the controls about reconciliations processes are weak and invoice-to-collection steps are not thought through, it will lead to leakage and further aggravate the receivables issues.

Supply chain finance is another avenue for Startups to manage receivables better. In this case, buyers with better credit ratings extend their credit lines to the suppliers (startups) for any credit limit for bill discounting.

Inventory Management

Startups requiring an inventory-based model always face the risk of illiquid/unsold stocks and sales returns. This is especially true for large e-com and direct-to-customer (D2C) brands. Demand forecasting and optimizing the back-end supply chain comes with its own cost regarding resource deployment and management bandwidth. To the great solace, off-the-shelf software is available that integrates orders from various sources and assists in the demand forecast process.

With the regulatory structures placed by e-com market players, D2C brands stock the products on Sales on Return (SOR) basis to e-Com players. The uncontrolled SOR transactions may lead to high inventory and gauge a large chunk of the most important fuel of the company – liquidity. Founders can avoid this situation with a robust plan and strong rigor in the monitoring and review process.

Managing trade payables requires planning at a granular level and monitoring the business activities in line with the plan. The deviations must be kept at minimal or calculated risk that may lead to known downside risk. Startups struggle to implement the basic controls on budgeting and the PO process. With the lack of controls and absence of a key matrix, the orders are placed without precise planning. The unwarranted trade creditors create a more significant issue in skewed working capital.

The delay in paying the creditors also leads to dilution in bargaining power to the vendors and sacrificing on the margin due to higher costs.

Receivable management starts when startups enter a contract with the customers. In many cases, the payment terms capture the credit period.

One issue faced by startups with an inventory-based model is identifying the optimal order for Raw Materials in frequency and quantity.

Enormous quantities will block the capital, and small amounts will increase inward logistics costs. To overcome this, Companies entered an arrangement with vendors to supply material over a more extended period. Large companies provide support through vendor credit mechanisms. In this, the sellers to start ups provide financing support through their credit line. Startups pay the amount after the agreed period per the arrangement’s terms.

Posted by: Deepak Gupta